The Age

SPECIAL INVESTIGATION

12 -2-2018

Sydney Morning Herald

A tiny new levy introduced in the wake of the 2009 Black Saturday bushfires was integral to The Age’s unlocking of a long-held and closely guarded secret - the wealth of the Catholic Church.

The 2013 Victorian Fire Services Property Levy imposed a small tax on the value of all Victorian, properties including those owned by religious institutions.

For the first time, government authorities had a reason to value the thousands of cathedrals, churches, monasteries, schools, offices and residences owned by all churches in Victoria.

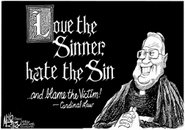

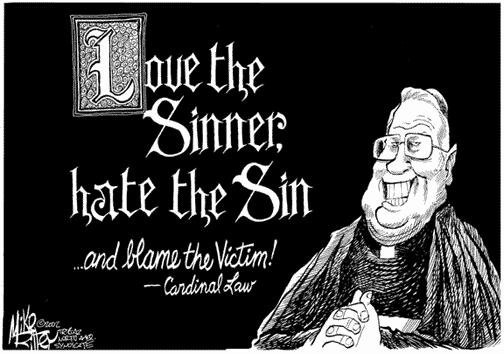

Our interest as investigative reporters had been sparked by the church’s horrendous record of child sexual abuse, cover ups and, in particular, its miserly approach to compensating abuse survivors for their suffering.

The wealth of the church in Australia, as it is in much of the world, had long seemed unknowable. Could the treasures it had built up over millennia even be valued?

We had tried to investigate over a number of years, but had run into insurmountable obstacles.

Then in mid-2017 we noticed an old story in a suburban newspaper in which the church had complained about paying the fire services levy.

If the church was paying the levy, it seemed likely that councils were valuing its property. We followed up the story to confirm that professional valuers engaged by councils now routinely valued church property.

It was this knowledge that allowed us to undertake a long and complex investigation, in which we:

- Identified the many names under which church properties are owned;

- Made 40 freedom of information (FOI) and other information requests to local councils seeking the valuation data;

- Pored through church directories and consulted multiple sources across the state to help identify and confirm what were church properties;

- Gained exclusive access to a database of more than 10,000 properties to help with cross-checking;

- Submitted FOI requests for federal government data on the value of church school assets;

- Combed dozens of financial reports of church entities including internal banks, school administrations, an insurance and investment business, charities, hospitals and nursing homes;

- Scoured through hundreds of pages of church authority minutes and other records, and

- Unearthed multiple financial documents in royal commission files.

After initial success with a small pilot run of FOI requests to councils,The Age hit two major research hurdles: lawyers and the church itself.

Local councils, who seemed increasingly anxious about upsetting the church, sought advice from specialist FOI lawyers. Many decided they could not, or would not, release the data we needed.

In the case of the Melbourne City Council, senior officers chose to consult the church about the FOI and the possible release of values for often historic, inner city properties. Acting on the advice of the church, the council then refused to release it through FOI.

We entered extensive negotiations about other ways the council might find to release the information.

Melbourne City Council was not the only one. Negotiations with councils took months and included warnings from some that they would take of legal action to withhold data. Eventually, however, most co-operated.

Only four refused to provide the information: Cardinia, Mornington Peninsula, Baw Baw and Swan Hill shires.

After much wrangling, we put together a database of more than 1800 properties owned by the church in Victoria, taking in most of metropolitan Melbourne and key regional cities including Geelong, Ballarat and Bendigo.

We then painstakingly worked through it, often identifying properties that had been missed, and returning to the councils for additional information. Slowly we compiled a database that we were confident was the basis to calculate the value of the church’s property assets in Victoria.

From there we were able to extrapolate, using conservative assumptions and detailed data about church congregations, the number of schools, parishes and the like, to estimate the value of church assets for the rest of Victoria and, ultimately, Australia-wide.

As a result we have what we believe is the most comprehensive media assessment of the church’s wealth anywhere in the world.

Catholic Inc.

What the Church is really worth

The Catholic Church in Victoria is worth more than $9 billion, making it the biggest non-government property owner in the state and much wealthier than it has admitted in evidence to major inquiries into child sexual abuse.

A six-month investigation by The Age has found that the church misled the Royal Commission into Institutional Responses to Child Sexual Abuse by grossly undervaluing its property portfolio while claiming that increased payments to abuse survivors would likely require cuts to its social programs.

Figures extrapolated from a huge volume of Victorian council valuation data show the church has more than $30 billion in property and other assets, Australia wide.

Based on these figures, the church is clearly the largest non-government property owner, by value, in the state, and close to the largest in Australia, rivalling giant Westfield, with its vast network of shopping centres and other assets.

The church also has extensive non-property assets including Catholic Church Insurance and its own internal banks – often known as Catholic Development Funds – which have total assets of several billion dollars, including more than $1 billion in Melbourne.

And it has other investments, including in superannuation and telecommunications. A church-owned fund manager has more than $1.4 billion under management.

Asked specifically to nominate a value for the assets of the church and its associated entities, Melbourne archdiocese communications director Shane Healy said such information was “not available”.

Results from the investigation come in the wake of the royal commission, and four years after the tabling of the Victorian parliamentary inquiry into abuse.

They raise serious new questions about the church’s decades-long bid to avoid or minimise compensation payments to abuse survivors.

The royal commission reported that payments averaged just $35,000 under the Melbourne Response, the compensation scheme established by the then archbishop George Pell in 1996, a total of $11.3 million to 324 survivors of child sexual abuse.

In 2015, the Melbourne archdiocese paid $39 million - more than three times the total compensation amount - for new premium offices, the heritage-listed Industry House in East Melbourne, near St Patrick’s Cathedral.

“These figures confirm what we have known; there is huge inequity between the Catholic Church’s wealth and their responses to survivors,” said Helen Last, chief executive of the In Good Faith Foundation, which supports abuse survivors.

“The 600 survivors registered for our foundation’s services continue to experience minimal compensation and lack of comprehensive care in relation to their church abuses. They say their needs are the lowest of church priorities.”

Healy said the church's meeting the claims of survivors whose complaints of abuse were upheld was “amongst its highest priorities”. He said that since that report the church had paid an extra $17.2 million to survivors.

The Age’s investigation also calls into question the privileges the church enjoys, including exemptions from nearly all forms of taxation and billions of dollars in government funding each year to run services - $7.9 billion for its Australian schools alone in 2015.

It involved obtaining property valuations from 36 Victorian councils, including most of the Melbourne metropolitan area, Geelong, Ballarat and Bendigo, many under freedom of information.

It identified more than 1860 church-owned properties with “capital improved value” (land plus buildings) of just under $7 billion.

What they’re worth

Browse the gallery below to see the value of some of the church’s most iconic properties.

St Patrick’s Cathedral

Cathedral Place, East Melbourne

Property value

$44,630,000